What Is the Booming Business Today?

Outline:

– What “booming” really means and why it matters now

– Signals that separate durable growth from hype

– Sectors with real momentum today and why

– Business model trade‑offs: asset‑light vs. asset‑heavy

– How to validate a niche and de‑risk entry

– Conclusion and near‑term roadmap

What “Booming” Really Means Right Now

Ask ten people what a booming business looks like and you’ll hear ten different answers. Some picture lines out the door; others imagine charts rising at a perfect angle. In practice, “booming” is a composite: rapid, compounding demand; healthy unit economics; resilience to rate, supply, or policy shocks; and a clear path to defensible advantage. The reason this matters now is simple—capital is more selective than a few years ago, and operational slack is expensive. When capital tightens, only growth with traction, pricing power, and operational discipline earns the right to keep scaling.

Useful yardsticks make the definition concrete. Revenue growth north of the underlying market by a wide margin is one. If a sector expands 6% annually and a venture sustains 25–40% without extreme discounting, that’s a hint. Gross margins that hold or improve as volume rises tell you demand is not purely promotional. Payback periods under a year for customer acquisition in software, or within a few seasons for services, signal a healthy engine. Where inventories turn faster while stockouts decline, operational maturity is forming. And when churn falls as cohorts age, your product is actually solving pain rather than riding a fad.

Because different industries have different physics, benchmarks vary. Capital‑light tools might deliver 70–85% gross margins but require steady research cycles to stay relevant. Hard‑asset plays accept 25–45% gross margins yet can lock in long contracts and indexed pricing. Policy exposure can be a catalyst or a cliff; subsidies can accelerate adoption, but a sound plan assumes tapering support. A practical checklist helps:

– Demand growth that outpaces the broader market without heavy discounting

– Improving margins or efficiency as scale increases

– Reasonable payback windows and falling churn

– Supply stability and diversified inputs

– Regulatory clarity or credible compliance paths

Layer these together and “booming” stops looking like a headline and starts reading like a balance of momentum, quality, and durability.

Where Momentum Is Concentrating: Sectors to Watch

Several arenas are drawing sustained demand for structural reasons rather than novelty. Intelligent software and analytics remain a magnet because they compress time: drafting, summarizing, forecasting, and anomaly detection now happen in minutes, not hours. Early studies across service teams show material time savings per employee, often 15–40% on repetitive tasks, which translates to real wage efficiency. The key within this wave is not generic tooling but domain‑specific solutions with proprietary data, measurable error reduction, and tight workflows that customers rely on daily.

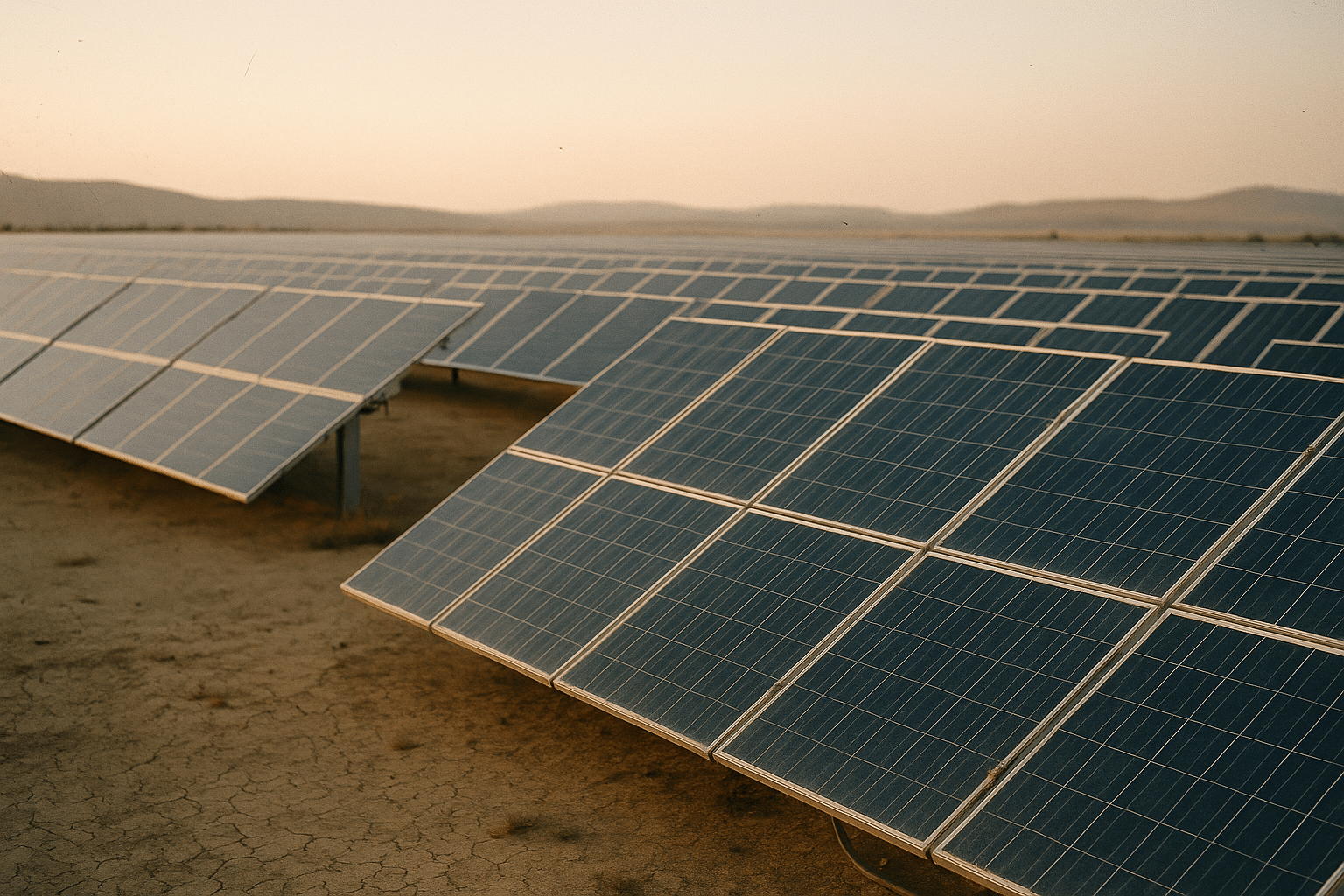

Energy transition lines are also humming. Utility‑scale and rooftop solar, storage integration, grid software, and heat electrification are expanding as costs fall and efficiency improves. Over the past decade, solar module prices dropped significantly, and installations climbed into the hundreds of gigawatts globally in a single year. Storage deployments are rising as well, because managing intermittency is no longer optional. Firms that pair installation expertise with monitoring and financing options are meeting both consumer and commercial appetite for predictable energy costs.

Health and care delivery innovations continue their quiet march. Telehealth and remote monitoring stabilized far above pre‑2020 baselines, and aging populations are driving sustained demand for at‑home services, diagnostics, and medication management. What makes this surge durable is reimbursement alignment in many markets and the employer push to contain costs through preventative care. Offerings that integrate data sharing, adherence nudges, and clear outcomes reporting are building trust with payers and patients alike.

Cybersecurity and privacy remain non‑negotiable as attack surfaces expand. Annual spending in this category has grown into the hundreds of billions globally, reflecting a shift from optional to essential. Demand concentrates in managed detection, identity, data loss prevention, and secure development practices that “bake in” protection rather than bolt it on. Logistics automation and last‑mile optimization round out the list: parcel volumes keep climbing, while city regulations, fuel costs, and service expectations push operators toward routing intelligence, micro‑fulfillment, and energy‑efficient fleets.

If you prefer a bird’s‑eye summary:

– Intelligent, domain‑specific software that saves measurable time or reduces errors

– Clean energy build‑out plus storage and grid orchestration services

– Hybrid care, remote monitoring, and outcomes‑based health offerings

– Cybersecurity across identity, data, and software supply chains

– Logistics optimization, micro‑fulfillment, and efficient delivery assets

Each of these clusters is propelled by cost curves, regulation, or demographic shifts that are hard to reverse—useful ingredients for staying power.

Model Trade‑offs: Asset‑Light vs. Asset‑Heavy Booms

Two ventures can ride the same demand wave and land in very different places depending on their model. Asset‑light businesses—software, marketplaces, content tools—tend to scale with minimal incremental cost. The allure is clear: high gross margins, short payback periods, fast iteration cycles, and geographic agility. Risks include commoditization, platform dependency, and competitive replication. Defenses in this camp come from proprietary data, network effects in focused communities, and workflows so embedded that switching becomes painful.

Asset‑heavy ventures—energy projects, manufacturing, logistics hubs—win differently. They lock in long‑term contracts, offer tangible capacity, and often benefit from policy incentives or regulated pricing. Trade‑offs include higher upfront capital, construction risk, permitting timelines, and maintenance complexity. Returns concentrate in execution: negotiate supply early, standardize designs, secure offtake agreements, and diversify funding sources. When done well, these businesses can deliver sturdy cash flows indexed to inflation or demand, which smooths out cycles.

Compare the two on practical dimensions:

– Margins: asset‑light often 70–85%, asset‑heavy 25–45%, but the latter may secure multi‑year visibility

– Speed: software ships weekly; infrastructure hits milestones quarterly or annually

– Moat: data and networks vs. location rights, interconnection queues, and scale economics

– Sensitivities: platform policies and talent churn vs. commodity prices and permitting delays

– Financing: revenue‑backed lines and subscriptions vs. project finance and long‑term debt

Neither path is inherently superior; fit depends on your appetite for variance, the reliability of inputs, and the leverage you can earn from expertise. A useful hybrid approach is common: a services layer wrapped around assets, or a product company that partners for capacity instead of owning it outright. The goal is to align your cost structure and risk surface with the specific edge you can maintain.

How to Validate a Booming Niche Before You Commit

Great ideas die from slow feedback. A disciplined validation loop trades grand narratives for measurable signals. Start by interviewing customers across roles—economic buyers, daily users, and the people who will maintain your solution. Map their current alternatives, switching costs, and failure modes. If three independent conversations converge on the same pain points and language, you’re close to a real problem. Next, quantify urgency. Look for budget line items, recent purchasing behavior, and whether buyers are replacing something or layering on top.

Use a data triad to triangulate momentum:

– Demand: search interest trends, job postings mentioning the capability, and conference agendas

– Supply: lead times, inventory turns, and capacity announcements by suppliers

– Pricing: changes in list prices, discounting intensity, and contract lengths

Where you see rising demand, tightening supply, and flattening discounts, you likely have pricing power. When discounts widen and deals stretch out, step back and ask why. For regulated spaces, read rulemaking calendars and interconnection or licensing queues; they reveal what projects may actually reach the market.

Build a minimum believable product, not a minimum possible product. Include the one or two features that create the promised outcome and a way to measure it. Pilot with a small cohort at full price but generous support. Success metrics should be unambiguous: time saved per task, error rate reduction, throughput increase, or energy cost variance. Share the dashboard weekly with customers and invite critique. If the pilot sponsor forwards your dashboard internally without prompting, you are close to a must‑have.

Close with unit economics under conservative assumptions. For software, model acquisition cost, activation rate, churn curves, and expansion paths. For services or assets, include utilization, maintenance windows, and financing costs. Run sensitivities on input prices and timeline slippage. Then write your kill criteria in advance:

– If payback exceeds a defined threshold, pause

– If pilot adoption stagnates after two cycles, pivot the wedge

– If compliance risks escalate beyond your tolerance, retrench

This discipline turns validation into an accelerator rather than a sinkhole for time and capital.

Conclusion and Next‑Step Roadmap for Founders and Investors

The through‑line is clear: booming businesses today blend real demand drivers with thoughtful model choices and crisp validation. Intelligent tools that save measurable time, energy solutions that stabilize costs, resilient care services, secure digital foundations, and efficient logistics all enjoy tailwinds that look durable rather than fleeting. None are guaranteed wins, but each offers avenues where focused execution can compound results even in cautious capital markets.

Over the next 18 months, favor focus over sprawl. Pick one wedge where you can be meaningfully different and instrument it deeply. Build proof faster than you build features, and publish outcomes that a skeptic would respect. Where policy shapes outcomes, design compliance into the product rather than treating it as paperwork. Where supply chains are fragile, hedge inputs early and reduce single points of failure. And where talent is the constraint, create simple playbooks that turn strong hires into force multipliers.

A practical sequence can help:

– Month 0–2: 20–30 buyer and user interviews; draft the one‑line value claim backed by a metric

– Month 2–4: ship the minimum believable product; run two paid pilots with clear success thresholds

– Month 4–6: lock the pricing model; document a repeatable sales motion or offtake agreement pattern

– Month 6–9: prune distractions; automate onboarding; negotiate financing that matches cash flow timing

Keep your dashboard honest and lightweight. If your core metric improves, compound; if it stalls, revisit assumptions quickly. Booming markets reward speed, but they reward clarity even more. Approach them with humility, curiosity, and tight feedback loops, and you position yourself to ride the swell rather than chase the wake.